Robo-advisors are increasingly popular a go-to choice for individuals looking for an easy way to manage their investments. These automated platforms leverage technology to create a custom investment portfolio based on your financial situation.

By using robo-advisors, you can start investing quickly in a varied selection of assets, such as equities, bonds, and property.

- Advantages of using a robo-advisor span:

- Competitive pricing

- Passive approach

- Financial goal alignment

- User-friendly interface

Robo-Advisors: A Beginner's Guide to Automated Investing

Are you just starting out to the world of investing? Do you wish to build your wealth but lack intimidated by traditional investment strategies? Robo-advisors may be the perfect solution for you. These automated services utilize algorithms and robotic technology to oversee your investments based on your risk tolerance.

A robo-advisor will query you about your investment preferences, then construct a personalized portfolio containing a diverse mix of assets. This portfolio construction helps to minimize risk and hopefully enhance your returns over time.

- Advantages of using a Robo-Advisor:

- Low Fees

- Accessibility

- Clarity

Robo-advisors provide a streamlined investing process, making it simpler for everyone to invest in the financial markets. Whether you're a beginner investor or a seasoned capitalist, robo-advisors can be a valuable get more info resource to help you achieve your wealth accumulation.

Investing Easy with Robo-Advisors

Are your clients looking to simplify their investment journey? Robo-advisors offer a convenient solution by handling the task of building and monitoring a diversified fund. These advanced platforms use algorithms to assess your risk tolerance and develop a tailored strategy that aligns their objectives.

- Benefits of Robo-Advisors:

- Minimal fees compared to traditional consultants

- Accessibility for individuals

- Diversification to reduce risk

Start your wealth-building process today with the simplicity of a robo-advisor.

Launch Your Investing Journey with Robo-Advisors: A Step-by-Step Guide

Stepping into the world of investing can feel daunting, but robo-advisors offer a simplified approach to building your wealth. These automated platforms oversee your investments based on your investment goals. Ready to get started? Here's a step-by-step guide to leveraging robo-advisors effectively:

- Identify a Robo-Advisor: Research different platforms and compare their fees, investment strategies, and features. Consider your requirements.

- Establish an Account: Provide essential information like your name, address, and Social Security number. You'll also need link your bank account.

- Submit a Risk Assessment: Answer questions about your investment knowledge, time horizon, and comfort level with market fluctuations. This helps the robo-advisor identify your suitable investment portfolio.

- Deposit Your Account: Transfer assets from your bank account to your robo-advisor platform. Start small and increase your contributions over time.

- Review Your Portfolio: Regularly check the performance of your investments and modify your asset allocation as appropriate. Keep in mind that investing is a long-term {strategy|approach|plan>.

Streamlined Investing: The Power of Robo-Advisors

In today's fast-paced world, discovering the time and expertise to navigate the complexities of investing can be a struggle. That's where robo-advisors come in. These automated platforms leverage cutting-edge technology to oversee your investments, providing a convenient way to grow your wealth. Robo-advisors typically analyze your financial goals and build a diversified portfolio tailored to your needs. They then dynamically adjust your investments, rebalancing them as market conditions shift. This automated approach allows you to devote your time and energy to other concerns, while knowing that your investments are being professionally managed.

- Additionally, robo-advisors often come with low expenses, making them an budget-friendly option for investors of all sizes

- In conclusion, robo-advisors can be a powerful tool for anyone looking to ease the investing process and achieve their long-term aspirations.

Discover the World of Passive Income Through Robo-Advisors

Are you dreaming about financial freedom and extra spending money? A robo-advisor could be your ticket to unlocking passive income. These automated platforms manage your investments with no human assistance, allowing you to let go and watch your portfolio grow.

A robo-advisor path typically begins by answering a short survey about your risk tolerance. Based on your responses, the platform constructs a personalized portfolio of investments that aligns with your targets.

- Regularly rebalancing ensures your portfolio stays on track, while accountability gives you a clear picture of your investments' performance.

Despite|your financial expertise is limited, a robo-advisor can be an excellent tool for building passive income. So consider this pathway and start your journey toward financial freedom today?

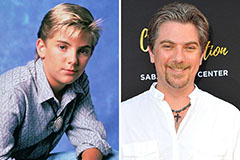

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!